What Are Wall Street Analysts' Target Price for Essex Property Stock?

Essex Property Trust, Inc. (ESS) is a real estate investment trust (REIT) focused on the ownership, operation, and development of multifamily residential properties. The company concentrates its efforts on high-demand West Coast markets, including Northern and Southern California, as well as the Seattle metropolitan area.

A limited housing supply and strong rental demand characterize these regions. By targeting supply-constrained urban areas, the company aims to generate consistent rental income while enhancing long-term property value through redevelopment and strategic investments. The company currently has a market capitalization of $17.05 billion.

The REIT’s stock has not been performing well for quite some time now. Over the past 52 weeks, Essex Property Trust’s shares have declined by 10.1%, while they are down by 7.2% year-to-date (YTD). The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 15.1% and 9.9% over the same periods, respectively.

Turning our focus to the sector-specific The Real Estate Select Sector SPDR Fund (XLRE), we see that the ETF has declined by 3.1% over the past 52 weeks and gained 3.3% YTD, thereby outperforming Essex Property Trust’s stock.

On July 29, Essex Property Trust reported robust second-quarter results. The REIT reported revenue of $469.83 million, which was 6.2% higher than the year-ago quarter and marginally higher than the $469.2 million that Wall Street analysts were expecting.

Its core FFO also increased by 2.3% year-over-year (YOY) to $4.03 per share, which was higher than the $3.99 per share FFO that analysts had expected. The company’s FFO growth was primarily driven by higher same-property revenue growth and property taxes in Washington.

On July 29, Essex Property Trust’s stock gained 2.7% intraday. However, it also dropped by 7.6% just the next day. The company enjoys significant liquidity and pays a stable dividend. However, it also faces an environment of still-high interest rates, which remains a concern.

For the fiscal year 2025, ending in December 2025, Wall Street analysts expect Essex Property Trust’s bottom line to grow by 2.2% YOY to $15.94 per share on a diluted basis, and increase by 3% to $16.41 per share in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters.

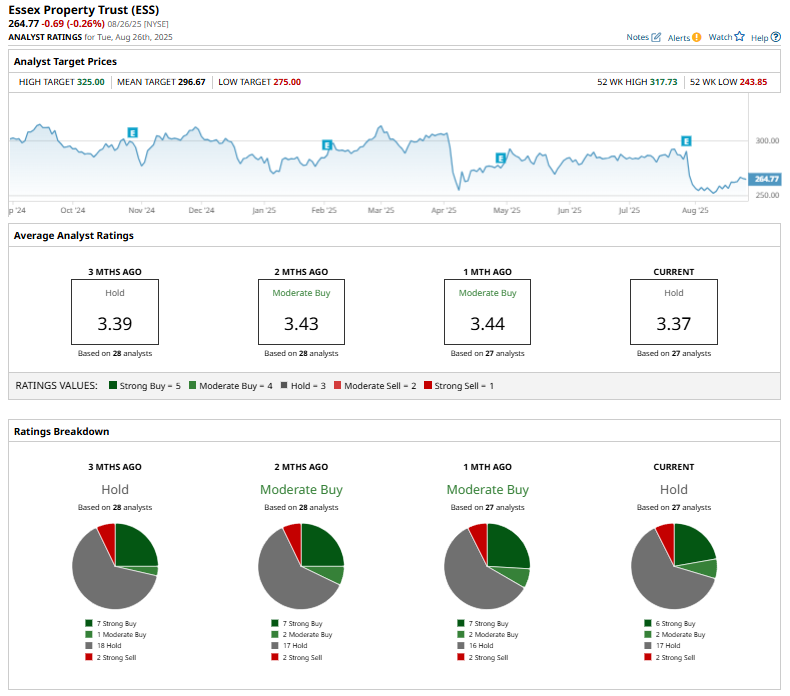

Among the 27 Wall Street analysts covering Essex Property Trust’s stock, the consensus is a “Hold.” That’s based on six “Strong Buy” ratings, two “Moderate Buys,” 17 “Hold” ratings, and two “Strong Sell” ratings.

The configuration of the ratings is less bullish than it was a month ago, with six “Strong Buy” ratings now, down from seven previously, and the overall rating has changed from “Moderate Buy” to “Hold.”

This month, Piper Sandler analyst Alexander Goldfarb notably downgraded Essex Property Trust’s stock from “Overweight” to “Neutral,” while cutting the price target from $355 to $275, citing a weak outlook for apartments and soft Q2 earnings reports in the real estate sector.

Essex Property Trust’s mean price target of $296.67 indicates a 12% upside over current market prices. The Street-high price target of $325 implies a potential upside of 22.7%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.