Why Big Money Is Doubling Down on Snowflake Stock

/An%20image%20of%20the%20Snowflake%20logo%20on%20a%20corporate%20office_%20Image%20by%20Grand%20Warszawski%20via%20Shutterstock_.jpg)

Snowflake (SNOW) continues to attract the attention of Wall Street's biggest players. Several large institutional investors have increased their stakes in the cloud data giant in recent months, indicating growing confidence in the company's long-term potential. The combination of increased institutional ownership, a wave of analyst price target upgrades, and strong stock performance suggests that Snowflake may be entering a new phase of growth.

Snowflake's stock has also seen significant gains recently, up 45% year-to-date (YTD) and over 100% over the last 52 weeks. Is this the right time to grab SNOW stock?

Big Money Pours In

One of the most notable moves in the first quarter of 2025 came from the Canada Pension Plan Investment Board (CPPIB), which increased its stake in Snowflake by 21.3%, according to MarketBeat. The fund acquired 57,253 shares, bringing its total holdings to 326,224 shares, worth $47.68 million. This translates to approximately 0.10% ownership in the company.

Several other institutional investors also increased their exposure to Snowflake stock. Vanguard Group, already Snowflake's largest shareholder, increased its stake by 1.2%, totaling nearly $3.97 billion. Price T. Rowe Associates increased its holdings by 19.2%, valued at $691.7 million. Furthermore, Goldman Sachs Group (GS) increased its stake by 22.2%, totaling $524.3 million, while Invesco (IVZ) now owns shares worth $451.4 million. Lastly, Nuveen LLC initiated a new position worth more than $555.8 million.

Overall, institutional investors own 65.1% of Snowflake's outstanding shares.

What Are Analysts Saying About SNOW Stock?

It is not just institutional investors that have recognized Snowflake’s potential. Many Wall Street analysts have raised their target prices for the stock, reflecting a growing belief that Snowflake's Data Cloud platform is well-positioned to meet the rising demand of enterprises for scalable data management and AI-driven analytics.

Recently, Morgan Stanley analyst Sanjit Singh reaffirmed his “Buy” rating on SNOW with a target price of $272. Singh described Brian Robins' appointment as a positive catalyst, citing his previous strong track record as CFO at GitLab. For context, on Sept. 3, Snowflake announced that Brian Robins will replace CFO Mike Scarpelli, effective Sept. 22. Singh also notes that Snowflake's strong financial structure contributes to a positive long-term outlook.

In late August, Piper Sandler raised its target price for SNOW from $215 to $285, while Wells Fargo raised it from $250 to $275. Both have an "Overweight" rating. Similarly, Cowen reiterated its "Buy" rating on the stock, while Raymond James raised its target from $212 to $230 and assigned an "Outperform" rating. Separately, Bank of America upgraded Snowflake from “Neutral” to “Buy,” lifting its target from $220 to $240.

Why Is Snowflake Getting So Much Attention?

One of the main reasons Snowflake is in the spotlight is its recent robust second-quarter fiscal 2026 earnings. This quarter saw accelerated revenue growth, increased adoption of its cloud-based data platform, and a surge of AI-driven innovation. As a cloud-based data platform, Snowflake enables organizations to store, manage, and analyze massive amounts of data in a fast, flexible, and cost-effective manner.

Snowflake's product revenue increased 32% year-on-year (YoY) to $1.09 billion, with a strong 125% net revenue retention rate indicating customer retention. AI continues to play an important role in Snowflake's growth. The company has now integrated AI throughout its platform, most notably with Snowflake Intelligence, Cortex AI SQL, Gen 2 Warehouse, and OpenFlow & Snowpark Connect.

Snowflake ended the quarter with $4.6 billion in cash and investments, leaving plenty of room to invest in innovation and go-to-market expansion.

While revenue growth is impressive, Snowflake's significant investments in AI and business expansion have put pressure on its bottom line. In the second quarter, the net loss per share came in at $0.89, compared to $0.95 the previous year. Analysts predict that the company will report a profit of $1.18 in fiscal 2026, up from a loss of $3.86 in fiscal 2025, with revenue growing by 27% YoY. Analysts also expect profits to rise by 40% in fiscal 2027, driven by a 23.6% increase in revenue. Snowflake's growth potential is reflected in its steep valuation, which is at 134x forward earnings.

SNOW on Wall Street

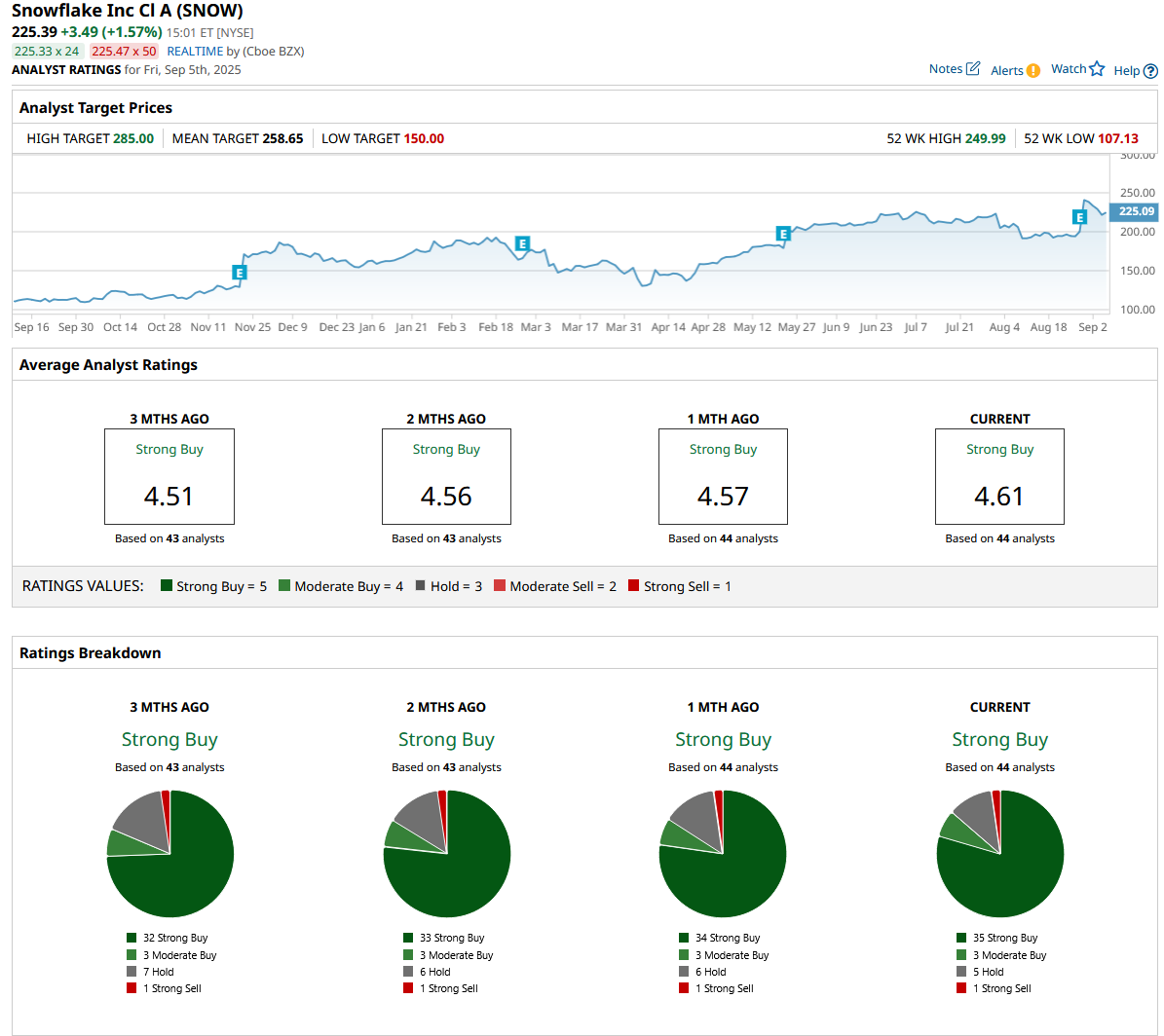

Overall, SNOW stock has garnered a “Strong Buy” rating on Wall Street. Out of the 44 analysts covering SNOW stock, 35 have rated it a “Strong Buy,” three suggest a “Moderate Buy,” five rate it a “Hold,” and one recommends a “Strong Sell.” Based on its average target price of $258.65, the stock has an upside potential of 16.6% from current levels. Plus, its high target price of $285 suggests the stock could gain as much as 28.4% over the next 12 months.

With a growing platform, strong financial discipline, and increased enterprise reliance on AI-enabled data strategies, the company appears well-positioned to capitalize on an expanding market opportunity. However, given its steep valuation, investors may want to wait for a better entry point between the $193 and $196 levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.