This Stock Market Ain’t No Party, It Ain’t No Disco, and Investors Need to Stop Fooling Around. Here’s What to Watch ASAP After Fed Day.

If you were around during the 1980s, I dare you to listen to Talking Heads’ “Life During Wartime,” released in 1979, and not get a little pep in your step.

The chorus of that song, part of which is the title of this article, was running through my head as I listened to Federal Reserve Chair (for now) Jerome Powell answer questions from reporters. It was not “just another” meeting after a Fed interest rate decision. Because the Federal Open Market Committee (FOMC) decided to cut rates for the first time since December 2024.

A Rate Cut Gets a Lot of Talking Heads, Well, Talking

With nine months in between reductions in the federal funds rate target range, it is tough to call this a rate cut “cycle.” But with expectations high for further cuts in 2025, there’s uncertainty, gossip, and more swirling about what comes next.

My approach to these events has typically focused not on what the Fed actually does, but what the markets do in response to it. Not so much on the day of the rate change. What I’m looking for is the emergence of patterns, where before there was stagnation.

6 Reasons the Stock Market Looks Dangerous, and Not Like a Party, Right Now

This is a great time to do two things:

- Ignore the crowd

- Focus inward, on how you manage risk.

I continue to believe this is the most opportunistic market climate of my nearly 40 years in the professional investing business. And, at the same time, the most dangerous. Here are just some of the many reasons why.

- Fed policy, now that rate cut No. 1 for 2025 is in the books.

- Fed policy (yes, repeating myself), in an environment in which President Donald Trump is at odds with Federal Reserve leadership.

- A very narrow stock market. How narrow? Nearly $4 out of every $10 you have in an S&P 500 Index ($SPX) ETF is in 10 stocks. 10 very prominent stocks. But they lead an index which sells at close to its highest valuation in modern history.

- The self-fulfilling prophecy that index investing has become. There’s a lot of wealth tied up in those index funds. With a weaker job market now at the top of the Fed’s worry list, what happens to all of that 401k dollar inflow when people are laid off? History tells us they soon start to use it as a source of funds to live on, which can reverse one of the biggest “pump-priming” aspects of this bull market.

- Trade policy. Powell was clear in his reaction to highly uncertain tariff policy, more than 5 months after “Liberation Day.” He sees it as a hurdle to making confident decisions. That implies the same issue for investors, as they make their own investment choices in the weeks and months ahead.

- And, there’s the lingering concern about non-U.S. buyers of U.S. Treasury bonds. For decades, Japan, China, and OPEC have been among the biggest funders of U.S. debt. Is that still as reliable a support system as it has been?

No Time to Disco: Use Barchart’s Premier Data Instead

I don’t know what will happen next. But I can use my Barchart Premier subscription to help me see which way the proverbial wind is blowing. Here are some charts of major market segments, as represented by ETFs that track them.

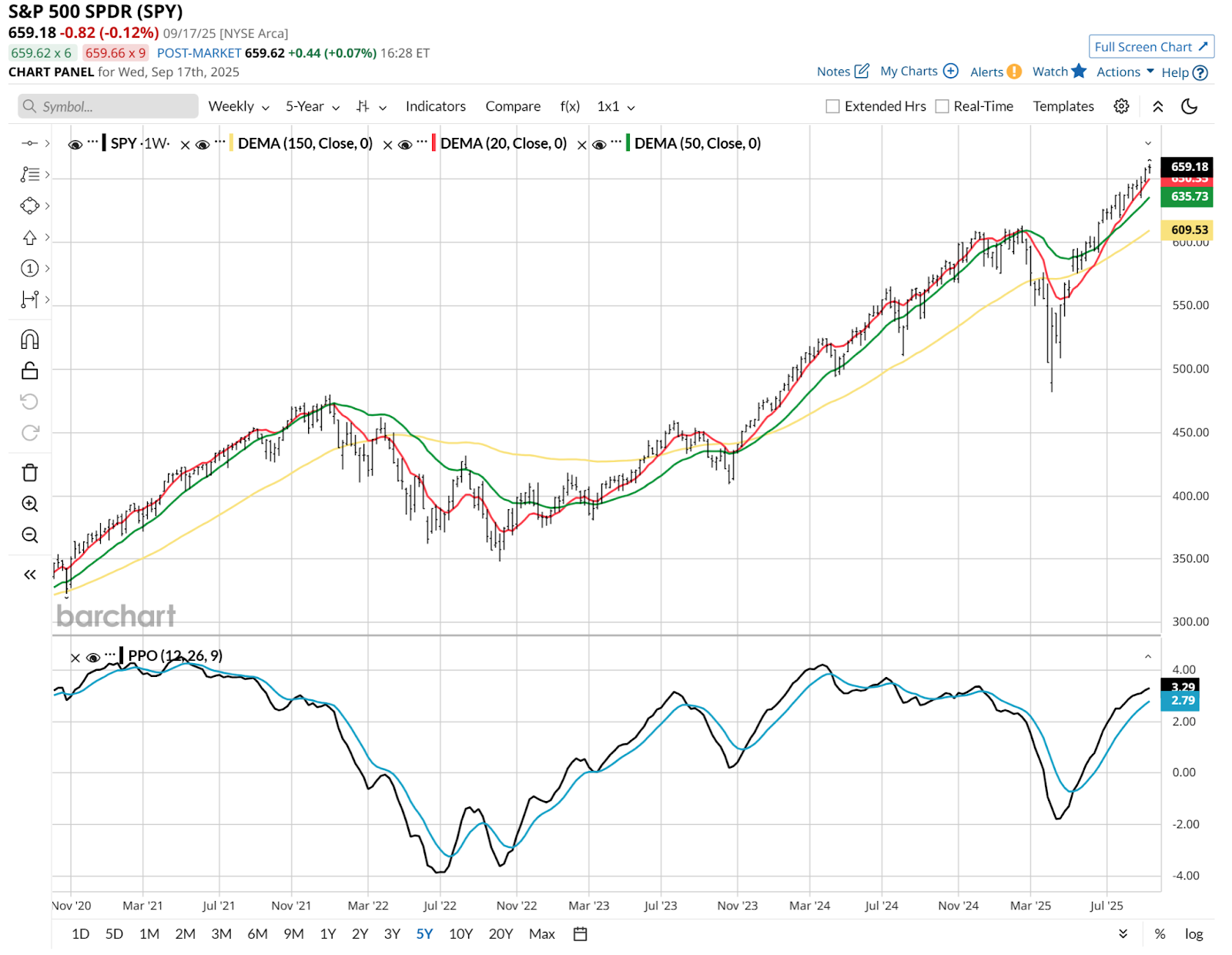

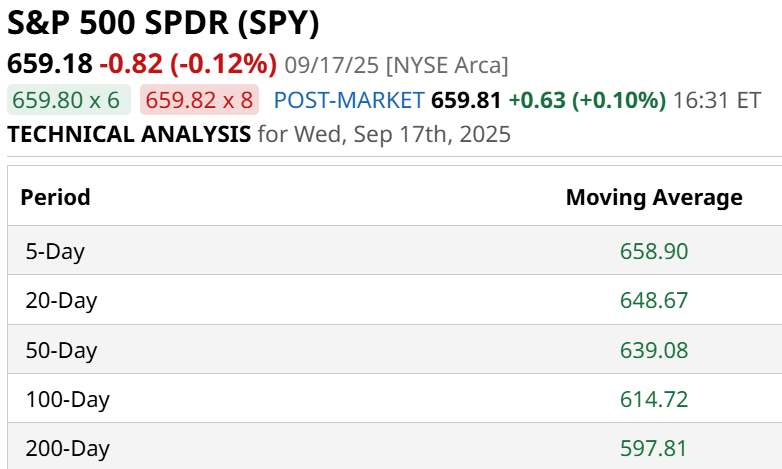

The S&P 500 SPDR ETF (SPY) has a tenuous look to it. Sure, it is flying. But that’s a long way above the 200-day moving average (in yellow).

SPY’s 200-day moving average is all the way down below $600. The ETF closed Wednesday nearly 10% above that level. That’s not typical.

The Russell 2000 iShares ETF (IWM) tracks the standard bearer of the U.S. small-cap segment, the Russell 2000 Index.

However, did you know that roughly 40% of that index is approaching a “debt cliff?” That means member companies have a lot of debt that is coming due soon and they have to refinance it to keep going. So if long-term rates (which the bond market controls, not the Fed) don’t dive soon, Trump won’t be the only one shouting “too late.”

So while IWM has rallied all the way back from the depths of April, it is also in double-top territory.

The U.S. Treasury 10-Year Note ETF (UTEN) is self-explanatory. Many traders may not realize that the benchmark note can be purchased through this 3-year old ETF. And many traders may not care. But this is going to be a big deal soon.

The price points modestly higher at the moment, but this smells like a news-driven situation to me, at least through the fall.

Seriously, Stop Fooling Around and Brace for What’s to Come

The Fed has made its move. And it is probably not the last one for this year, if wagering sites are accurate. But the question is this: What will break in a clear direction first? The Fed, the markets, or the collective patience of traders?

Some traders would tell us that today’s market is as simple as “follow the Fed.” But follow it where? The market has been chasing yields lower for 4 months. The 10-year U.S. Treasury Bond yield sank from 4.7% to 4.1% during that time. Now, the Fed has cut rates in 2025. Once. By only a quarter point.

To me, that leaves way too much meat on the proverbial bone in terms of uncertainty. And since a rising long bond yield is one of the few things we’ve seen disrupt the market this year, I’m in the camp of thinking this one event is just an appetizer. And that rates, and the stock market, are still very much at risk.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.