This 1 Cannabis Dividend Stock Yields 3%

Cannabis stocks are having an interesting week, thanks to President Donald Trump’s renewed interest in making cannabidiol (CBD) available to seniors via Medicare. The president posted a video Sunday on his Truth Social feed that promoted the health benefits of hemp-derived CBD, saying it can help seniors get more sleep, ease pain, and reduce stress.

Marijuana stocks jumped on the news, with Canopy Growth (CGC) rising 18%, Aurora Cannabis (ACB) increasing 25%, Cronos Group (CRON) moving 15% higher, and Tilray Brands (TLRY) skyrocketing 42%. While many of those names are giving back their gains in subsequent days, an out-of-the-way marijuana stock barely budged.

Perhaps the market has forgotten that Constellation Brands (STZ) is a major shareholder of Canopy Growth? Despite dropping off the board in 2024 and converting its common shares into non-voting and non-participating exchangeable shares, Constellation Brands still holds about 26 million shares of CGC stock through its shell company, Greenstar Canada Investment Limited Partnership. Those exchangeable shares are convertible into common shares on a 1-for-1 basis, representing roughly 14% of the company’s stock if converted.

For investors who are looking for an opportunity to profit from the marijuana space and possible action by the U.S. government, Constellation Brands offers an indirect, diversified path. But is it a good investment right now?

About Constellation Brands Stock

With its headquarters in Rochester, New York, Constellation Brands is the third-largest beer company in the U.S. and also a producer of high-end wine and spirits. The company’s brands include Corona beer and Kim Crawford wine.

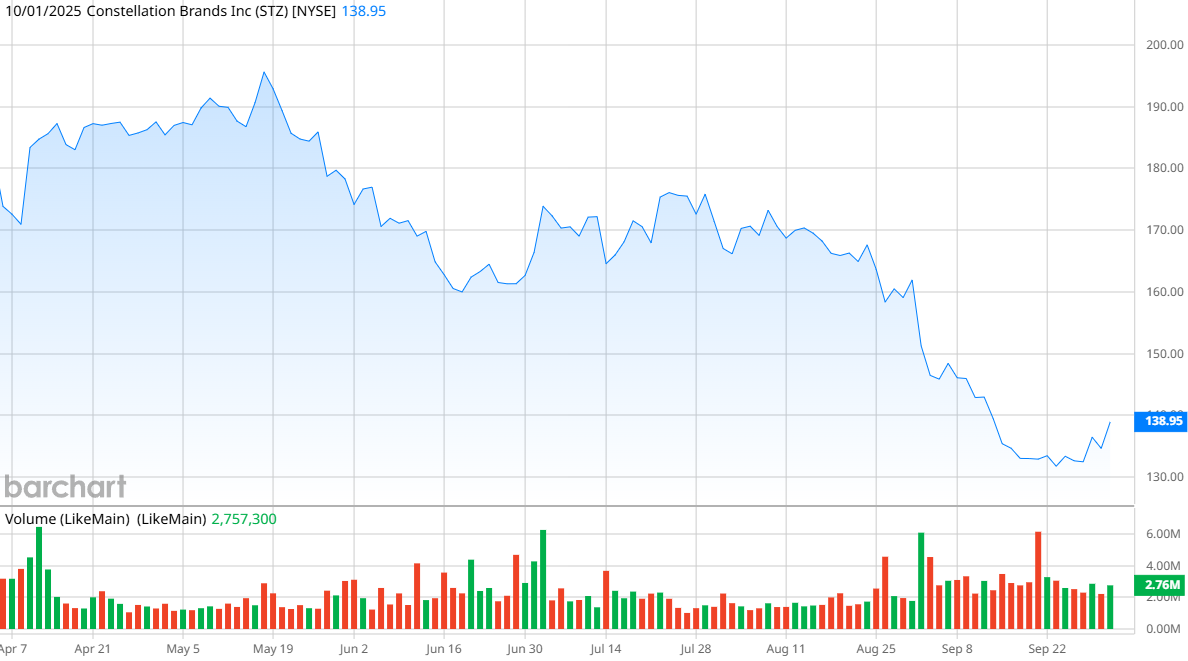

With a market capitalization of $24.5 billion, STZ stock has had a rough 2025, down 37% on a year-to-date (YTD) basis. STZ stock is just 5% off its 52-week low and is performing worse than competitors Boston Beer (SAM), which is down 26% in 2025, and Molson Coors Beverage (TAP), down 20%.

Constellation Brands is also expensive, even by its standards. It currently has a price-to-earnings (P/S) ratio of 46.4, which is higher than its 10-year median of 25.8. So, at current levels, the stock is overvalued.

But one advantage to Constellation Brands is that it pays a solid dividend yield of 3%, which is substantially better than the sector average yield of 1.9%. The company’s next dividend payment will be Nov. 13, 2025, to shareholders of record on Oct. 30.

Constellation Brands Misses on Earnings

Constellation Brands earnings for the first quarter of fiscal 2026 were rocky. Revenue of $2.51 billion was down 6% from a year ago. The company reported adjusted income of $806 million, down 13% from last year. Earnings per share were $3.22, down 10% from the same quarter a year ago and $0.12 lower than analysts expected.

Beer shipments fell by 3% from last year, while wine and spirits were off by 30.4% because of the company’s sale of its Svedka vodka brand to Sazerac, which makes Fireball and Southern Comfort.

“While we continued to face softer consumer demand largely driven by what we believe to be non-structural socioeconomic factors, our teams remain focused on executing the key initiatives that underpinned the outlook we recently provided for fiscals 2026 to 2028,” CEO Bill Newlands said.

Management’s guidance for fiscal 2026 calls for beer sales growth of up to 3%, with wine and spirit sales declines of 17% to 20% compared to last year, attributed to the Svedka sale and the company’s decision in June to sell several wine brands to The Wine Group, including Woodbridge, Meiomi, Cooks, and others, to focus on higher-priced wines. The company is forecasting earnings per share for the full year from a range of $12.60 to $12.90.

What Do Analysts Expect for STZ Stock?

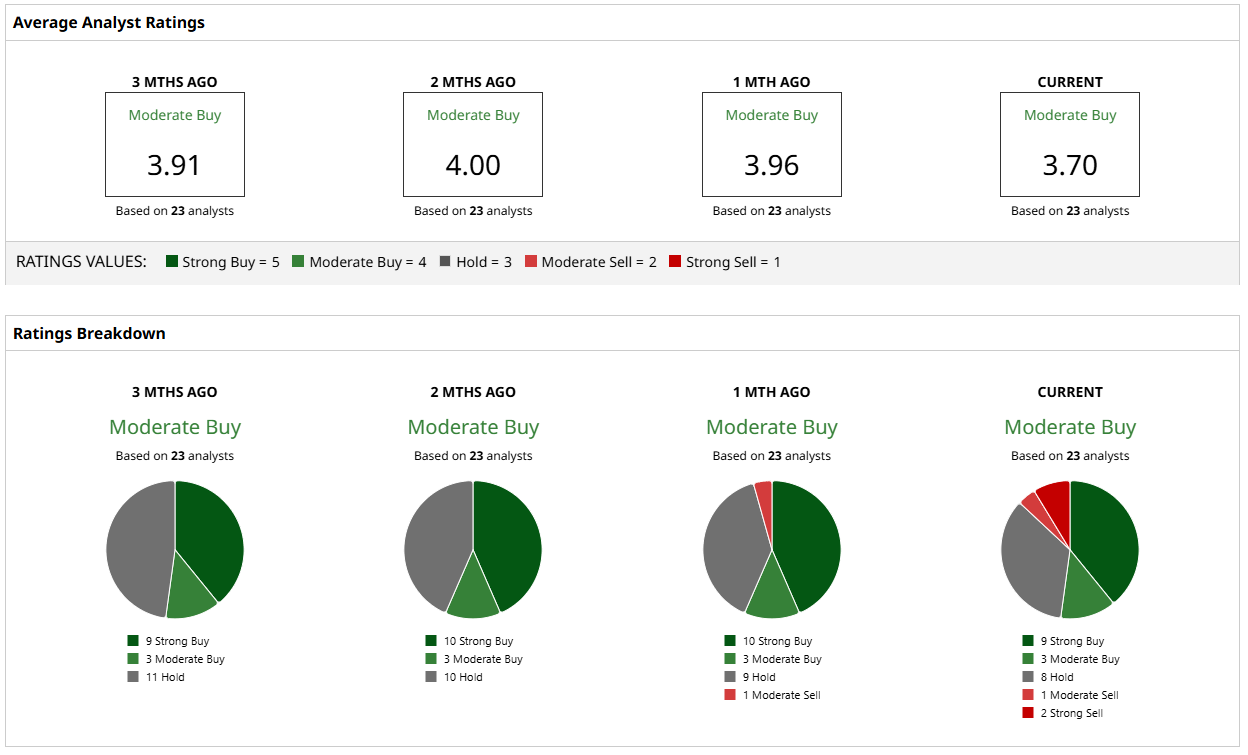

Analysts are all over the board when it comes to STZ stock. Of the 23 who currently follow the brand, there is a consensus “Moderate Buy” rating, with 12 who are bullish on the stock. Three analysts have “Sell” ratings, and eight others suggest holding.

Analysts have a consensus price target of $178.23, which implies a potential 28% increase for the stock, although the most bearish analyst’s target of $123 warns that the stock could face a slight short-term loss.

While Constellation Brands has some support from analysts, there are numerous things working against the company. The company’s going through a transition by divesting itself of some of its wine and spirit brands, which will naturally lead to a decline in sales. It’s also negatively affected by increased tariffs imposed by the U.S. on aluminum and steel imports, as well as increased tariffs imposed by Canada on wine and spirits.

Its ownership stake in Canopy Growth makes Constellation Brands an intriguing play for investors who are hoping to capitalize on the possible softening of U.S. laws on marijuana. And the oversized dividend is appealing. But the sagging beverage market and tariff challenges are too many to overcome for me to recommend STZ stock at this point.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.